Page 5 - Q3 GI/J&J Newsletter, 2019

P. 5

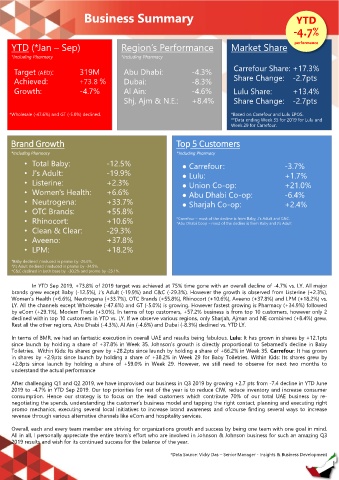

Business Summary YTD

-4.7%

YTD (*Jan – Sep) Region’s Performance Market Share performance

*Including Pharmacy *Including Pharmacy

Target (AED): 319M Abu Dhabi: -4.3% Carrefour Share: +17.3%

Achieved: +73.8 % Dubai: -8.3% Share Change: -2.7pts

Growth: -4.7% Al Ain: -4.6% Lulu Share: +13.4%

Shj, Ajm & N.E.: +8.4% Share Change: -2.7pts

*Wholesale (-47.6%) and GT (-5.0%) declined. *Based on Carrefour and Lulu EPOS.

**Data ending Week 35 for 2019 for Lulu and

Week 29 for Carrefour.

Brand Growth Top 5 Customers

*Including Pharmacy *Including Pharmacy

• Total Baby: -12.5% ● Carrefour : -3.7%

• J's Adult: -19.9% ● Lulu: +1.7%

• Listerine: +2.3% ● Union Co-op: +21.0%

• Women's Health: +6.6% ● Abu Dhabi Co-op: -6.4%

• Neutrogena: +33.7% ● Sharjah Co-op: +2.4%

• OTC Brands: +55.8%

• Rhinocort: +10.6% *Carrefour – most of the decline is from Baby, J’s Adult and C&C.

*Abu Dhabi Coop – most of the decline is from Baby and J’s Adult

• Clean & Clear: -29.3%

• Aveeno: +37.8%

• LPM: +18.2%

*Baby declined / reduced in promo by -26.6%.

*J’s Adult declined / reduced in promo by -34.5%.

*C&C declined in both base by -30.2% and promo by -23.1%.

In YTD Sep 2019, +73.8% of 2019 target was achieved at 75% time gone with an overall decline of -4.7% vs. LY. All major

brands grew except Baby (-12.5%), J’s Adult (-19.9%) and C&C (-29.3%). However the growth is observed from Listerine (+2.3%),

Women’s Health (+6.6%), Neutrogena (+33.7%), OTC Brands (+55.8%), Rhinocort (+10.6%), Aveeno (+37.8%) and LPM (+18.2%) vs.

LY. All the channels except Wholesale (-47.6%) and GT (-5.0%) is growing. However fastest growing is Pharmacy (+34.9%) followed

by eCom (+29.1%), Modern Trade (+3.0%). In terms of top customers, +57.2% business is from top 10 customers, however only 2

declined within top 10 customers in YTD vs. LY. If we observe various regions, only Sharjah, Ajman and NE combined (+8.4%) grew.

Rest all the other regions, Abu Dhabi (-4.3%), Al Ain (-4.6%) and Dubai (-8.3%) declined vs. YTD LY.

In terms of BMR, we had an fantastic execution in overall UAE and results being fabulous. Lulu: It has grown in shares by +12.1pts

since launch by holding a share of +37.8% in Week 35. Johnson’s growth is directly proportional to Sebamed’s decline in Baby

Toiletries. Within Kids: Its shares grew by +28.2pts since launch by holding a share of +66.2% in Week 35. Carrefour: It has grown

in shares by +2.9pts since launch by holding a share of +38.2% in Week 29 for Baby Toiletries. Within Kids: Its shares grew by

+2.8pts since launch by holding a share of +59.0% in Week 29. However, we still need to observe for next two months to

understand the actual performance

After challenging Q1 and Q2 2019, we have improvised our business in Q3 2019 by growing +2.7 pts from -7.4 decline in YTD June

2019 to -4.7% in YTD Sep 2019. Our top priorities for rest of the year is to reduce CIW, reduce inventory and increase consumer

consumption. Hence our strategy is to focus on the lead customers which contribute 70% of our total UAE business by re-

negotiating the spends, understanding the customer’s business model and tapping the right contact, planning and executing right

promo mechanics, executing several local initiatives to increase brand awareness and ofcourse finding several ways to increase

revenue through various alternative channels like eCom and hospitality services.

Overall, each and every team member are striving for organizations growth and success by being one team with one goal in mind.

All in all, I personally appreciate the entire team’s effort who are involved in Johnson & Johnson business for such an amazing Q3

2019 results and wish for its continued success for the balance of the year.

*Data Source: Vicky Das – Senior Manager - Insights & Business Development