Page 12 - 2018 Zumba Employee Benefits Guide

P. 12

12

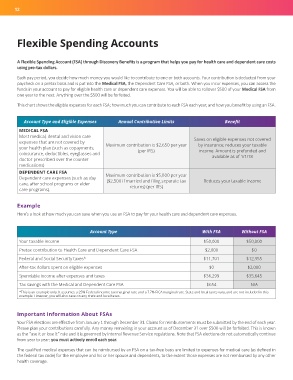

Flexible Spending Accounts

A Flexible Spending Account (FSA) through Discovery Benefits is a program that helps you pay for health care and dependent care costs

using pre-tax dollars.

Each pay period, you decide how much money you would like to contribute to one or both accounts. Your contribution is deducted from your

paycheck on a pretax basis and is put into the Medical FSA, the Dependent Care FSA, or both. When you incur expenses, you can access the

funds in your account to pay for eligible health care or dependent care expenses. You will be able to rollover $500 of your Medical FSA from

one year to the next. Anything over the $500 will be forfeited.

This chart shows the eligible expenses for each FSA; how much you can contribute to each FSA each year, and how you benefit by using an FSA.

Account Type and Eligible Expenses Annual Contribution Limits Benefit

MEDICAL FSA

Most medical, dental and vision care Saves on eligible expenses not covered

expenses that are not covered by Maximum contribution is $2,650 per year by insurance; reduces your taxable

your health plan (such as copayments, (per IRS) income. Amount is prefunded and

coinsurance, deductibles, eyeglasses and available as of 1/1/18

doctor-prescribed over the counter

medications)

DEPENDENT CARE FSA Maximum contribution is $5,000 per year

Dependent care expenses (such as day ($2,500 if married and filing separate tax Reduces your taxable income

care, after school programs or elder returns) (per IRS)

care programs).

Example

Here’s a look at how much you can save when you use an FSA to pay for your health care and dependent care expenses.

Account Type With FSA Without FSA

Your taxable income $50,000 $50,000

Pretax contribution to Health Care and Dependent Care FSA $2,000 $0

Federal and Social Security taxes* $11,701 $12,355

After-tax dollars spent on eligible expenses $0 $2,000

Spendable income after expenses and taxes $36,299 $35,645

Tax savings with the Medical and Dependent Care FSA $654 N/A

*This is an example only. It assumes a 25% Federal income tax marginal rate and a 7.7% FICA marginal rate. State and local taxes vary, and are not included in this

example. However, you will also save on any state and local taxes.

Important Information About FSAs

Your FSA elections are effective from January 1 through December 31. Claims for reimbursements must be submitted by the end of each year.

Please plan your contributions carefully. Any money remaining in your account as of December 31 over $500 will be forfeited. This is known

as the “use it or lose it” rule and it is governed by Internal Revenue Service regulations. Note that FSA elections do not automatically continue

from year to year; you must actively enroll each year.

The qualified medical expenses that can be reimbursed by an FSA on a tax-free basis are limited to expenses for medical care (as defined in

the federal tax code) for the employee and his or her spouse and dependents, to the extent those expenses are not reimbursed by any other

health coverage.