Page 49 - LGB Group

P. 49

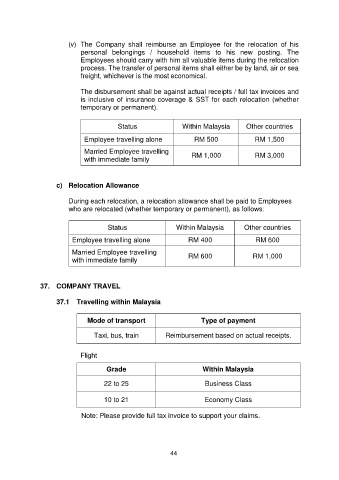

(v) The Company shall reimburse an Employee for the relocation of his

personal belongings / household items to his new posting. The

Employees should carry with him all valuable items during the relocation

process. The transfer of personal items shall either be by land, air or sea

freight, whichever is the most economical.

The disbursement shall be against actual receipts / full tax invoices and

is inclusive of insurance coverage & SST for each relocation (whether

temporary or permanent).

Status Within Malaysia Other countries

Employee travelling alone RM 500 RM 1,500

Married Employee travelling RM 1,000 RM 3,000

with immediate family

c) Relocation Allowance

During each relocation, a relocation allowance shall be paid to Employees

who are relocated (whether temporary or permanent), as follows:

Status Within Malaysia Other countries

Employee travelling alone RM 400 RM 600

Married Employee travelling RM 600 RM 1,000

with immediate family

37. COMPANY TRAVEL

37.1 Travelling within Malaysia

Mode of transport Type of payment

Taxi, bus, train Reimbursement based on actual receipts.

Flight

Grade Within Malaysia

22 to 25 Business Class

10 to 21 Economy Class

Note: Please provide full tax invoice to support your claims.

44