Page 50 - LGB Group

P. 50

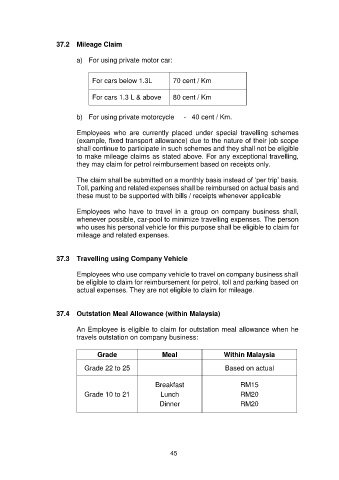

37.2 Mileage Claim

a) For using private motor car:

For cars below 1.3L 70 cent / Km

For cars 1.3 L & above 80 cent / Km

b) For using private motorcycle - 40 cent / Km.

Employees who are currently placed under special travelling schemes

(example, fixed transport allowance) due to the nature of their job scope

shall continue to participate in such schemes and they shall not be eligible

to make mileage claims as stated above. For any exceptional travelling,

they may claim for petrol reimbursement based on receipts only.

The claim shall be submitted on a monthly basis instead of ‘per trip’ basis.

Toll, parking and related expenses shall be reimbursed on actual basis and

these must to be supported with bills / receipts whenever applicable

Employees who have to travel in a group on company business shall,

whenever possible, car-pool to minimize travelling expenses. The person

who uses his personal vehicle for this purpose shall be eligible to claim for

mileage and related expenses.

37.3 Travelling using Company Vehicle

Employees who use company vehicle to travel on company business shall

be eligible to claim for reimbursement for petrol, toll and parking based on

actual expenses. They are not eligible to claim for mileage.

37.4 Outstation Meal Allowance (within Malaysia)

An Employee is eligible to claim for outstation meal allowance when he

travels outstation on company business:

Grade Meal Within Malaysia

Grade 22 to 25 Based on actual

Breakfast RM15

Grade 10 to 21 Lunch RM20

Dinner RM20

45