Page 162 - inside page.cdr

P. 162

AMINES & PLASTICIZERS LTD

NOTES FORMING PART OF CONSOLIDATED

FINANCIAL STATEMENTS AS AT 31ST MARCH 201 9

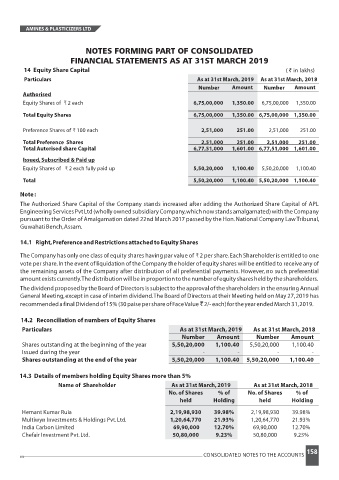

14 Equity Share Capital ( ` in lakhs)

Particulars As at 31st March, 2019 As at 1st March, 2013 8

Number Amount Number Amount

Authorised

Equity Shares of 2 each 6,75,00,000 1,350.00 6,75,00,000 1,350.00

Total Equity Shares 6,75,00,000 1,350.00 6,75,00,000 1,350.00

Preference Shares of 100 each 2,51,000 251.00 2,51,000 251.0 0

Total Preference Shares 2,51,000 251.00 2,51,000 251.00

Total Autorised share Capital 6,77,51,000 1,601.00 6,77,51,000 1,601.00

Issued,Subscribed & Paid up

Equity Shares of 2 each fully paid up 5,50,20,000 1,100.40 5,50,20,000 1,100.40

Total 5,50,20,000 1,100.40 5,50,20,000 1,100.40

Note:

The Authorized Share Capital of the Company stands increased after adding the Authorized Share Capital of APL

EngineeringServicesPvtLtd(whollyownedsubsidiaryCompany,whichnowstandsamalgamated)withtheCompany

pursuant to the Order of Amalgamation dated 22nd March 2017 passed by the Hon.National Company LawTribunal,

GuwahatiBench,Assam.

14.1 Right,PreferenceandRestrictionsattachedtoEquityShares

The Company has only one class of equity shares having par value of 2 per share.Each Shareholder is entitled to one

vote per share.In the event of liquidation of the Company the holder of equity shares will be entitled to receive any of

the remaining assets of the Company after distribution of all preferential payments. However, no such preferential

amountexistscurrently.Thedistributionwillbeinproportiontothenumberofequitysharesheldbytheshareholders.

The dividendproposedby theBoardofDirectorsissubjecttotheapprovaloftheshareholdersintheensuringAnnual

General Meeting,except in case of interim dividend.The Board of Directors at their Meeting held on May 27,2019 has

recommendedafinalDividendof15%(30paisepershareofFaceValue 2/-each)fortheyearendedMarch31,2019.`

14.2 Reconciliation of numbers of Equity Shares

Particulars As at 31st March,2019 As at 1st3 March ,2018

Number Amount Number Amount

Shares outstanding at the beginning of the year 5,50,20,000 1,100.40 5,50,20,000 1,100.40

Issued during the year - - - -

Shares outstanding at the end of the year 5,50,20,000 1,100.40 5,50,20,000 1,100.40

14.3 Details of members holding Equity Shares more than 5%

Name of Shareholder As at 31st March,201 9 As at 31st March,20 18

No.of Shares % of No.of Shares % of

held Holding held Holding

Hemant Kumar Ruia 2,19,98,930 39.98% 2,19,98,930 39.98%

Multiwyn Investments & Holdings Pvt.Ltd. 1,20,64,770 21.93% 1,20,64,770 21.93%

India Carbon Limited 69,90,000 12.70% 69,90,000 12.70%

Chefair Investment Pvt.Ltd. 50,80,000 9.23% 50,80,000 9.23%

158

CONSOLIDATED NOTES TO THE ACCOUNTS