Page 165 - inside page.cdr

P. 165

ANNUAL REPORT 2018 - 2019

NOTES FORMING PART OF CONSOLIDATED

FINANCIAL STATEMENTS AS AT 31ST MARCH 201 9

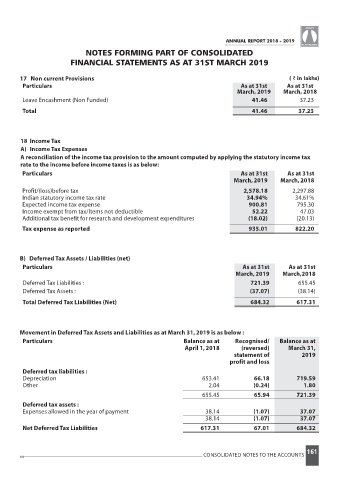

17 Non current Provisions ( ` in lakhs)

Particulars As at 31st As at 31st

March, 201 9 March, 201 8

Leave Encashment (Non Funded) 41.46 37.23

Total 41.46 37.23

18 Income Tax

A) Income Tax Expenses

A reconciliation of the income tax provision to the amount computed by applying the statutory income tax

rate to the income before income taxes is as below:

Particulars As at 31st As at 31st

March,201 9 March,201 8

Profit/(loss)before tax 2,578.18 2,297.88

Indian statutory income tax rate 34.94% 34.61%

Expected income tax expense 900.81 795.30

Income exempt from tax/Items not deductible 52.22 47.03

Additional tax benefit for research and development expenditures (18.02) (20.13)

Tax expense as reported 935.01 822.20

B) Deferred Tax Assets / Liabilities (net)

Particulars As at 31st As at 31st

March,201 9 March,201 8

Deferred Tax Liabilities : 721.39 655.45

Deferred Tax Assets : (37.07) (38.14)

Total Deferred Tax Liabilities (Net) 684.32 617.31

Movement in Deferred Tax Assets and Liabilities as at March 31,201 is as below :9

Particulars Balance as at Recognised/ Balance as at

April 1,201 8 (reversed) March 31,

statement of 201 9

profit and loss

Deferred tax liabilities :

Depr eciation 653.41 66.18 719.59

Other 2.04 (0.24) 1.80

655.45 65.94 721.39

Deferred tax assets :

Expenses allowed in the year of payment 38.14 (1.07) 37.07

38.14 (1.07) 37.07

Net Deferred Tax Liabilities 617.31 67.01 684.32

161

CONSOLIDATED NOTES TO THE ACCOUNTS