Page 14 - Rubrik 2022 FAQ

P. 14

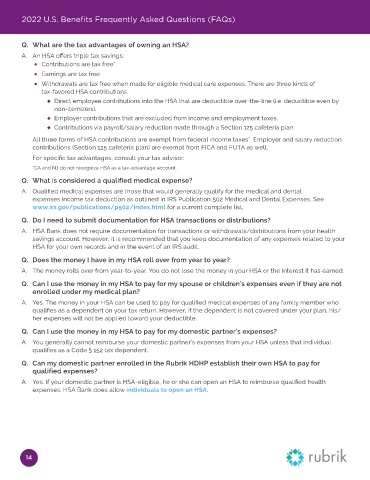

2022 U.S. Benefits Frequently Asked Questions (FAQs)

Q. What are the tax advantages of owning an HSA?

A. An HSA offers triple tax savings:

Contributions are tax free*

Earnings are tax free

Withdrawals are tax free when made for eligible medical care expenses. There are three kinds of

tax‑favored HSA contributions:

w Direct employee contributions into the HSA that are deductible over‑the‑line (i.e. deductible even by

non‑itemizers).

w Employer contributions that are excluded from income and employment taxes.

w Contributions via payroll/salary reduction made through a Section 125 cafeteria plan.

All three forms of HSA contributions are exempt from federal income taxes*. Employer and salary reduction

contributions (Section 125 cafeteria plan) are exempt from FICA and FUTA as well.

For specific tax advantages, consult your tax advisor.

*CA and NJ do not recognize HSA as a tax‑advantage account.

Q. What is considered a qualified medical expense?

A. Qualified medical expenses are those that would generally qualify for the medical and dental

expenses income tax deduction as outlined in IRS Publication 502 Medical and Dental Expenses. See

www.irs.gov/publications/p502/index.html for a current complete list.

Q. Do I need to submit documentation for HSA transactions or distributions?

A. HSA Bank does not require documentation for transactions or withdrawals/distributions from your health

savings account. However, it is recommended that you keep documentation of any expenses related to your

HSA for your own records and in the event of an IRS audit.

Q. Does the money I have in my HSA roll over from year to year?

A. The money rolls over from year‑to‑year. You do not lose the money in your HSA or the interest it has earned.

Q. Can I use the money in my HSA to pay for my spouse or children’s expenses even if they are not

enrolled under my medical plan?

A. Yes. The money in your HSA can be used to pay for qualified medical expenses of any family member who

qualifies as a dependent on your tax return. However, if the dependent is not covered under your plan, his/

her expenses will not be applied toward your deductible.

Q. Can I use the money in my HSA to pay for my domestic partner’s expenses?

A. You generally cannot reimburse your domestic partner’s expenses from your HSA unless that individual

qualifies as a Code § 152 tax dependent.

Q. Can my domestic partner enrolled in the Rubrik HDHP establish their own HSA to pay for

qualified expenses?

A. Yes. If your domestic partner is HSA‑eligible, he or she can open an HSA to reimburse qualified health

expenses. HSA Bank does allow individuals to open an HSA.

14