Page 19 - Rubrik 2022 FAQ

P. 19

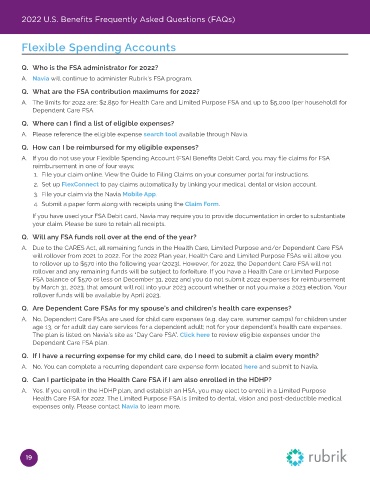

2022 U.S. Benefits Frequently Asked Questions (FAQs)

Flexible Spending Accounts

Q. Who is the FSA administrator for 2022?

A. Navia will continue to administer Rubrik’s FSA program.

Q. What are the FSA contribution maximums for 2022?

A. The limits for 2022 are: $2,850 for Health Care and Limited Purpose FSA and up to $5,000 (per household) for

Dependent Care FSA.

Q. Where can I find a list of eligible expenses?

A. Please reference the eligible expense search tool available through Navia.

Q. How can I be reimbursed for my eligible expenses?

A. If you do not use your Flexible Spending Account (FSA) Benefits Debit Card, you may file claims for FSA

reimbursement in one of four ways:

1. File your claim online. View the Guide to Filing Claims on your consumer portal for instructions.

2. Set up FlexConnect to pay claims automatically by linking your medical, dental or vision account.

3. File your claim via the Navia Mobile App.

4. Submit a paper form along with receipts using the Claim Form.

If you have used your FSA Debit card, Navia may require you to provide documentation in order to substantiate

your claim. Please be sure to retain all receipts.

Q. Will any FSA funds roll over at the end of the year?

A. Due to the CARES Act, all remaining funds in the Health Care, Limited Purpose and/or Dependent Care FSA

will rollover from 2021 to 2022. For the 2022 Plan year, Health Care and Limited Purpose FSAs will allow you

to rollover up to $570 into the following year (2023). However, for 2022, the Dependent Care FSA will not

rollover and any remaining funds will be subject to forfeiture. If you have a Health Care or Limited Purpose

FSA balance of $570 or less on December 31, 2022 and you do not submit 2022 expenses for reimbursement

by March 31, 2023, that amount will roll into your 2023 account whether or not you make a 2023 election. Your

rollover funds will be available by April 2023.

Q. Are Dependent Care FSAs for my spouse’s and children’s health care expenses?

A. No. Dependent Care FSAs are used for child care expenses (e.g. day care, summer camps) for children under

age 13, or for adult day care services for a dependent adult; not for your dependent’s health care expenses.

The plan is listed on Navia’s site as “Day Care FSA”. Click here to review eligible expenses under the

Dependent Care FSA plan.

Q. If I have a recurring expense for my child care, do I need to submit a claim every month?

A. No. You can complete a recurring dependent care expense form located here and submit to Navia.

Q. Can I participate in the Health Care FSA if I am also enrolled in the HDHP?

A. Yes. If you enroll in the HDHP plan, and establish an HSA, you may elect to enroll in a Limited Purpose

Health Care FSA for 2022. The Limited Purpose FSA is limited to dental, vision and post‑deductible medical

expenses only. Please contact Navia to learn more.

19