Page 108 - GB SUBJECTS NEW - ALL PAGE NO

P. 108

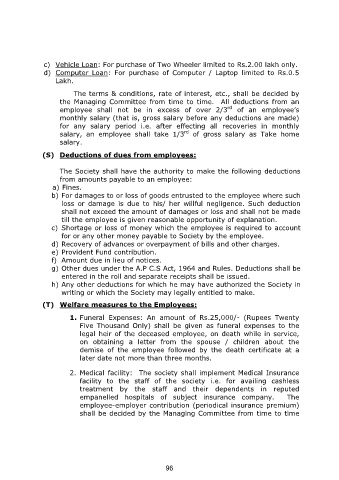

c) Vehicle Loan: For purchase of Two Wheeler limited to Rs.2.00 lakh only.

d) Computer Loan: For purchase of Computer / Laptop limited to Rs.0.5

Lakh.

The terms & conditions, rate of interest, etc., shall be decided by

the Managing Committee from time to time. All deductions from an

rd

employee shall not be in excess of over 2/3 of an employee’s

monthly salary (that is, gross salary before any deductions are made)

for any salary period i.e. after effecting all recoveries in monthly

rd

salary, an employee shall take 1/3 of gross salary as Take home

salary.

(S) Deductions of dues from employees:

The Society shall have the authority to make the following deductions

from amounts payable to an employee:

a) Fines.

b) For damages to or loss of goods entrusted to the employee where such

loss or damage is due to his/ her willful negligence. Such deduction

shall not exceed the amount of damages or loss and shall not be made

till the employee is given reasonable opportunity of explanation.

c) Shortage or loss of money which the employee is required to account

for or any other money payable to Society by the employee.

d) Recovery of advances or overpayment of bills and other charges.

e) Provident Fund contribution.

f) Amount due in lieu of notices.

g) Other dues under the A.P C.S Act, 1964 and Rules. Deductions shall be

entered in the roll and separate receipts shall be issued.

h) Any other deductions for which he may have authorized the Society in

writing or which the Society may legally entitled to make.

(T) Welfare measures to the Employees:

1. Funeral Expenses: An amount of Rs.25,000/- (Rupees Twenty

Five Thousand Only) shall be given as funeral expenses to the

legal heir of the deceased employee, on death while in service,

on obtaining a letter from the spouse / children about the

demise of the employee followed by the death certificate at a

later date not more than three months.

2. Medical facility: The society shall implement Medical Insurance

facility to the staff of the society i.e. for availing cashless

treatment by the staff and their dependents in reputed

empanelled hospitals of subject insurance company. The

employee-employer contribution (periodical insurance premium)

shall be decided by the Managing Committee from time to time

96