Page 12 - Obligatory Zakat Made Easy

P. 12

ZAKAT ON SHARES

Definition

Dr Yusoff Al-Qardhawi in his book Fiqh-Zakat defines

shares as valuable papers traded especially in the stock

exchange.

Share certificates in a company listed in the stock

exchange are easy to liquidate compared to shares in a

company that is not listed in the stock exchange such as a

private limited company or a co-operative.

Definition

The share owner can separate the calculation of zakat on

shares into two groups:

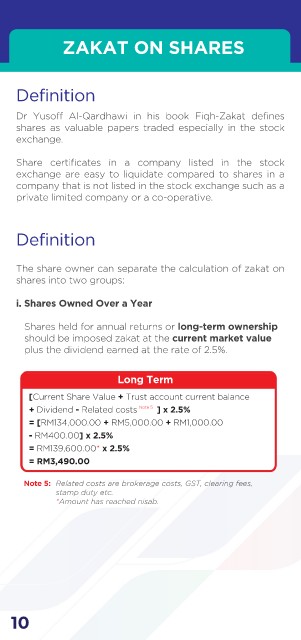

i. Shares Owned Over a Year

Shares held for annual returns or long-term ownership

should be imposed zakat at the current market value

plus the dividend earned at the rate of 2.5%.

Long Term

[Current Share Value + Trust account current balance

Note 5

+ Dividend - Related costs ] x 2.5%

= [RM134,000.00 + RM5,000.00 + RM1,000.00

- RM400.00] x 2.5%

= RM139,600.00* x 2.5%

= RM3,490.00

Note 5: Related costs are brokerage costs, GST, clearing fees,

stamp duty etc.

*Amount has reached nisab.

10