Page 9 - Obligatory Zakat Made Easy

P. 9

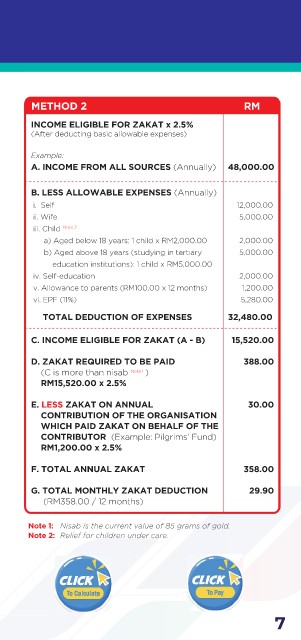

METHOD 2 RM

INCOME ELIGIBLE FOR ZAKAT x 2.5%

(After deducting basic allowable expenses)

Example:

A. INCOME FROM ALL SOURCES (Annually) 48,000.00

B. LESS ALLOWABLE EXPENSES (Annually)

i. Self 12,000.00

ii. Wife 5,000.00

iii. Child Note 2

a) Aged below 18 years: 1 child x RM2,000.00 2,000.00

b) Aged above 18 years (studying in tertiary 5,000.00

education institutions): 1 child x RM5,000.00

iv. Self-education 2,000.00

v. Allowance to parents (RM100.00 x 12 months) 1,200.00

vi. EPF (11%) 5,280.00

TOTAL DEDUCTION OF EXPENSES 32,480.00

C. INCOME ELIGIBLE FOR ZAKAT (A - B) 15,520.00

D. ZAKAT REQUIRED TO BE PAID 388.00

(C is more than nisab )

Note 1

RM15,520.00 x 2.5%

E. LESS ZAKAT ON ANNUAL 30.00

CONTRIBUTION OF THE ORGANISATION

WHICH PAID ZAKAT ON BEHALF OF THE

CONTRIBUTOR (Example: Pilgrims’ Fund)

RM1,200.00 x 2.5%

F. TOTAL ANNUAL ZAKAT 358.00

G. TOTAL MONTHLY ZAKAT DEDUCTION 29.90

(RM358.00 / 12 months)

Note 1: Nisab is the current value of 85 grams of gold.

Note 2: Relief for children under care.

Click

Click Click

Click

To Pay

To Calculate To Pay

To Calculate

7