Page 10 - Obligatory Zakat Made Easy

P. 10

ZAKAT ON BUSINESS

Business Zakat Postulate

Allah (SWT) said:

“By men whom neither traffic nor merchandise can divert

from the Remembrance of Allah nor from regular Prayer,

nor from the practice of regular Charity: their (only) fear is

for the Day when hearts and eyes will be transformed.”

An-Nur: Verse 37

Prophet Muhammad (PBUH) said:

“It is not accumulated on scattered property and is not

scattered on accumulated property with the intention to

avoid charity (zakat for the payer) or reduce the collection

(for amil) and everything between two persons who share,

that both must return them equally (based on the ratio)”.

Narrated by Bukhari

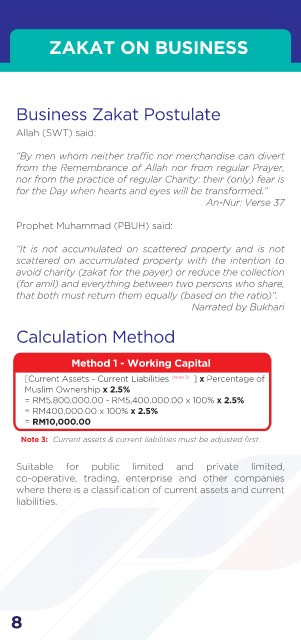

Calculation Method

Method 1 - Working Capital

[Current Assets - Current Liabilities ] x Percentage of

(Note 3)

Muslim Ownership x 2.5%

= RM5,800,000.00 - RM5,400,000.00 x 100% x 2.5%

= RM400,000.00 x 100% x 2.5%

= RM10,000.00

Note 3: Current assets & current liabilities must be adjusted first.

Suitable for public limited and private limited,

co-operative, trading, enterprise and other companies

where there is a classification of current assets and current

liabilities.

8