Page 15 - Obligatory Zakat Made Easy

P. 15

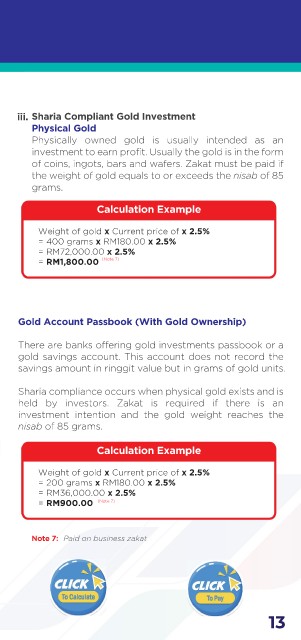

iii. Sharia Compliant Gold Investment

Physical Gold

Physically owned gold is usually intended as an

investment to earn profit. Usually the gold is in the form

of coins, ingots, bars and wafers. Zakat must be paid if

the weight of gold equals to or exceeds the nisab of 85

grams.

Calculation Example

Weight of gold x Current price of x 2.5%

= 400 grams x RM180.00 x 2.5%

= RM72,000.00 x 2.5%

= RM1,800.00 (Note 7)

Gold Account Passbook (With Gold Ownership)

There are banks offering gold investments passbook or a

gold savings account. This account does not record the

savings amount in ringgit value but in grams of gold units.

Sharia compliance occurs when physical gold exists and is

held by investors. Zakat is required if there is an

investment intention and the gold weight reaches the

nisab of 85 grams.

Calculation Example

Weight of gold x Current price of x 2.5%

= 200 grams x RM180.00 x 2.5%

= RM36,000.00 x 2.5%

= RM900.00 (Note 7)

Note 7: Paid on business zakat

Click Click

Click

Click

To Pay

To Calculate

To Calculate To Pay

13