Page 16 - Obligatory Zakat Made Easy

P. 16

iv. Shariah Non-Compliant Gold Investments

Gold Account Passbook (No Gold Ownership)

A gold investment passbook or gold savings account is

non-compliant with sharia if no physical gold is kept.

Zakat is charged only on the principal investment if the

amount exceeds the annual nisab. It is calculated

according to the savings zakat formula.

Virtual Gold Account

Virtual gold is gold traded for non-physical investment.

The virtual gold business uses an electronic platform.

Investors who have an account with a particular broker

may make buying and selling gold calls at current

prices displayed on the platform but they cannot claim

the physical gold they have purchased.

Since this gold trade does not involve physical gold, it

is considered as sharia non-compliant. Zakat is charged

only on the principal investment if the amount exceeds

the annual nisab rate. It is categorised as savings zakat

payment.

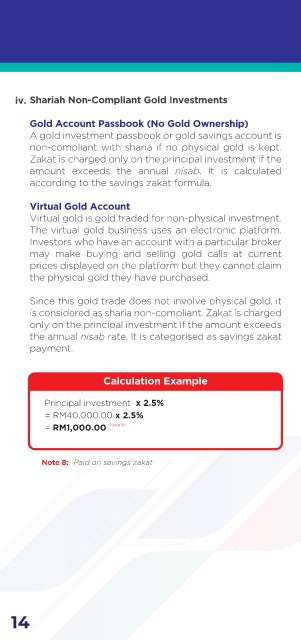

Calculation Example

Principal investment x 2.5%

= RM40,000.00 x 2.5%

= RM1,000.00 (Note 8)

Note 8: Paid on savings zakat

14