Page 11 - Obligatory Zakat Made Easy

P. 11

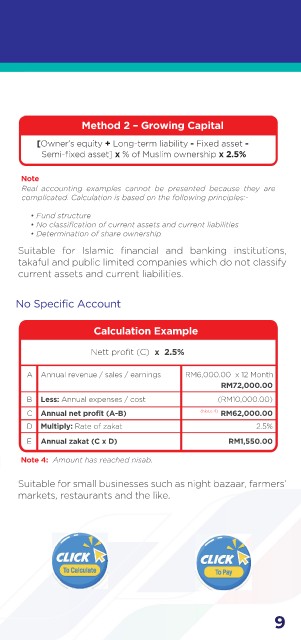

Method 2 – Growing Capital

[Owner’s equity + Long-term liability - Fixed asset -

Semi-fixed asset] x % of Muslim ownership x 2.5%

Note

Real accounting examples cannot be presented because they are

complicated. Calculation is based on the following principles:-

• Fund structure

• No classification of current assets and current liabilities

• Determination of share ownership

Suitable for Islamic financial and banking institutions,

takaful and public limited companies which do not classify

current assets and current liabilities.

No Specific Account

Calculation Example

Nett profit (C) x 2.5%

A Annual revenue / sales / earnings RM6,000.00 x 12 Month

RM72,000.00

B Less: Annual expenses / cost (RM10,000.00)

C Annual net profit (A-B) (Note 4) RM62,000.00

D Multiply: Rate of zakat 2.5%

E Annual zakat (C x D) RM1,550.00

Note 4: Amount has reached nisab.

Suitable for small businesses such as night bazaar, farmers’

markets, restaurants and the like.

Click

Click

Click Click

To Calculate

To Pay

To Calculate To Pay

9