Page 8 - Obligatory Zakat Made Easy

P. 8

ZAKAT ON INCOME

Definition

According to Prof. Dr Yusuf Al-Qaradhawi and Dr Hussein

Shahatah, salary and income zakat are called al-Mal

al-Mustafad, i.e. zakat which is derived from salary and

professional income.

Categories of Salary and Income

i. Employment Salary and Wages: Salaries, wages,

bonuses, overtime pay, gratuity, compensation,

pensions, prizes, awards, intensive, ESOS (employee

stock option scheme) and any income derived from

service or employment.

ii. Freelance Income

• Payment of professional consultancy services

• Project payments or profits received by contractors

• Commission and residual income such as sales of

insurance, takaful, unit trust, brokerage & the like

• Royalties or commissions from writing, publications,

arts activities and so on

iii. Income-Generating Property (Mustaghallat)

• Rental income from assets such as buildings,

premises, equipment, etc.

• Products of livestock such as milk, eggs, honey, etc.

* Income not required for zakat calculation:

Claims of lodging, overseas travel, entertainment, mileage

and other

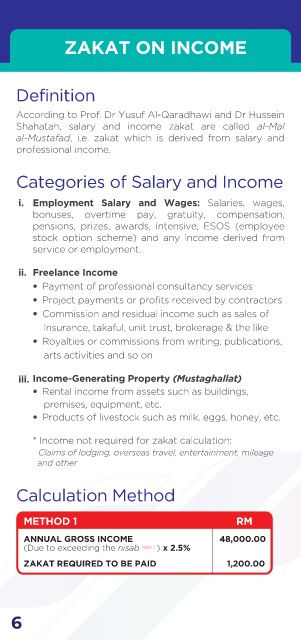

Calculation Method

METHOD 1 RM

ANNUAL GROSS INCOME 48,000.00

(Due to exceeding the nisab ) x 2.5%

Note 1

ZAKAT REQUIRED TO BE PAID 1,200.00

6