Page 19 - Obligatory Zakat Made Easy

P. 19

ZAKAT ON EPF & LTAT

Definition

The Employees Provident Fund (EPF) & the Armed Forces

Fund Board (LTAT) are savings made by individuals

during their period of service and they satisfy all the

required conditions of zakat except for "full ownership",

which will be fulfilled once the money is withdrawn from

the EPF & LTAT.

Calculation Method

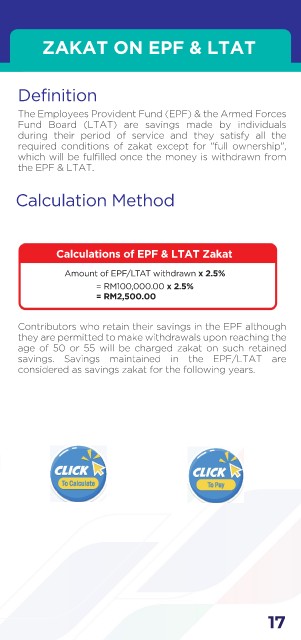

Calculations of EPF & LTAT Zakat

Amount of EPF/LTAT withdrawn x 2.5%

= RM100,000.00 x 2.5%

= RM2,500.00

Contributors who retain their savings in the EPF although

they are permitted to make withdrawals upon reaching the

age of 50 or 55 will be charged zakat on such retained

savings. Savings maintained in the EPF/LTAT are

considered as savings zakat for the following years.

Click Click

Click

Click

To Pay

To Calculate

To Calculate To Pay

17