Page 18 - Obligatory Zakat Made Easy

P. 18

ZAKAT ON SAVINGS

Definition

Money that is deposited in a savings account whether

fixed deposit, current savings, ASB or other forms of

deposits at a bank or any financial institution.

Zakat Rate

2.5% zakat is imposed on the total of savings balance at

the end of the year equivalent or more than the nisab.

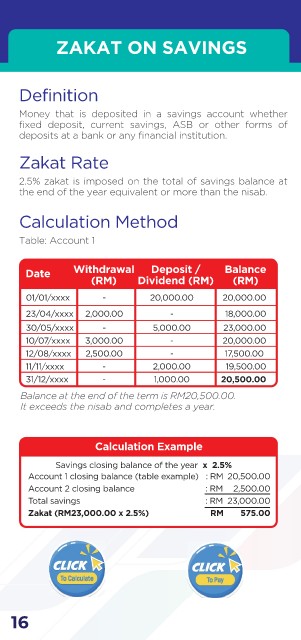

Calculation Method

Table: Account 1

Date Withdrawal Deposit / Balance

(RM) Dividend (RM) (RM)

01/01/xxxx - 20,000.00 20,000.00

23/04/xxxx 2,000.00 - 18,000.00

30/05/xxxx - 5,000.00 23,000.00

10/07/xxxx 3,000.00 - 20,000.00

12/08/xxxx 2,500.00 - 17,500.00

11/11/xxxx - 2,000.00 19,500.00

31/12/xxxx - 1,000.00 20,500.00

Balance at the end of the term is RM20,500.00.

It exceeds the nisab and completes a year.

Calculation Example

Savings closing balance of the year x 2.5%

Account 1 closing balance (table example) : RM 20,500.00

Account 2 closing balance : RM 2,500.00

Total savings : RM 23,000.00

Zakat (RM23,000.00 x 2.5%) RM 575.00

Click Click

Click

Click

To Pay

To Calculate To Pay

To Calculate

16