Page 20 - Obligatory Zakat Made Easy

P. 20

ZAKAT & TAX

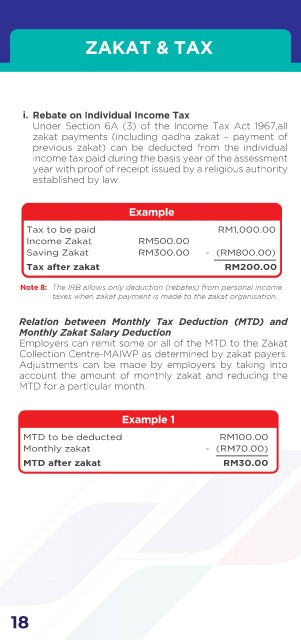

i. Rebate on Individual Income Tax

Under Section 6A (3) of the Income Tax Act 1967,all

zakat payments (including qadha zakat – payment of

previous zakat) can be deducted from the individual

income tax paid during the basis year of the assessment

year with proof of receipt issued by a religious authority

established by law.

Example

Tax to be paid RM1,000.00

Income Zakat RM500.00

Saving Zakat RM300.00 - (RM800.00)

Tax after zakat RM200.00

Note 8: The IRB allows only deduction (rebates) from personal income

taxes when zakat payment is made to the zakat organisation.

Relation between Monthly Tax Deduction (MTD) and

Monthly Zakat Salary Deduction

Employers can remit some or all of the MTD to the Zakat

Collection Centre-MAIWP as determined by zakat payers.

Adjustments can be made by employers by taking into

account the amount of monthly zakat and reducing the

MTD for a particular month.

Example 1

MTD to be deducted RM100.00

Monthly zakat - (RM70.00)

MTD after zakat RM30.00

18