Page 22 - 黃振祐

P. 22

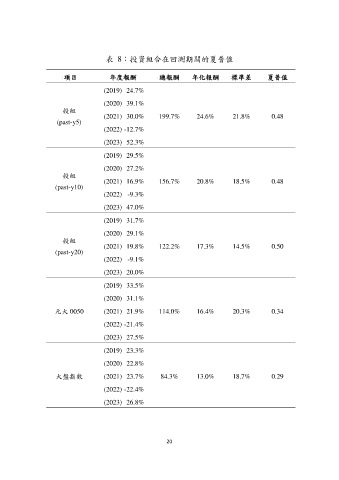

表 8:投資組合在回測期間的夏普值

項目 年度報酬 總報酬 年化報酬 標準差 夏普值

(2019) 24.7%

(2020) 39.1%

投組

(2021) 30.0% 199.7% 24.6% 21.8% 0.48

(past-y5)

(2022) -12.7%

(2023) 52.3%

(2019) 29.5%

(2020) 27.2%

投組

(2021) 16.9% 156.7% 20.8% 18.5% 0.48

(past-y10)

(2022) -9.3%

(2023) 47.0%

(2019) 31.7%

(2020) 29.1%

投組

(2021) 19.8% 122.2% 17.3% 14.5% 0.50

(past-y20)

(2022) -9.1%

(2023) 20.0%

(2019) 33.5%

(2020) 31.1%

元大 0050 (2021) 21.9% 114.0% 16.4% 20.3% 0.34

(2022) -21.4%

(2023) 27.5%

(2019) 23.3%

(2020) 22.8%

大盤指數 (2021) 23.7% 84.3% 13.0% 18.7% 0.29

(2022) -22.4%

(2023) 26.8%

20