Page 694 - Microeconomics, Fourth Edition

P. 694

c16GeneralEquilibriumTheory.qxd 8/16/10 9:13 PM Page 668

668 CHAPTER 16 GENERAL EQUILIBRIUM THEORY

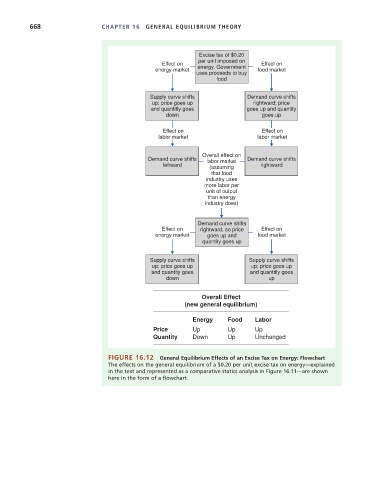

Excise tax of $0.20

per unit imposed on

Ef fect on Ef fect on

energy market energy . Government food market

uses proceeds to buy

food

Supply curve shifts Demand curve shifts

up; price goes up rightward; price

and quantitly goes goes up and quantity

dow n goes up

Ef fect on Ef fect on

labor market labor market

Overall ef fect on

Demand curve shifts labor market Demand curve shifts

leftward (assumin g rightward

that food

industry uses

more labor per

unit of output

than energy

industry does)

Demand curve shifts

Ef fect on rightward, so price Ef fect on

energy market goes up and food market

quantity goes up

Supply curve shifts Supply curve shifts

up; price goes up up; price goes up

and quantity goes and quantitly goes

dow n up

Overall Effect

(new general equilibrium)

Energy Food Labor

Price Up Up Up

Quantity Down Up Unchanged

FIGURE 16.12 General Equilibrium Effects of an Excise Tax on Energy: Flowchart

The effects on the general equilibrium of a $0.20 per unit excise tax on energy—explained

in the text and represented as a comparative statics analysis in Figure 16.11—are shown

here in the form of a flowchart.