Page 9 - CCFA Journal - 8th Issue

P. 9

加中金融 经济热点 Economy hotspots

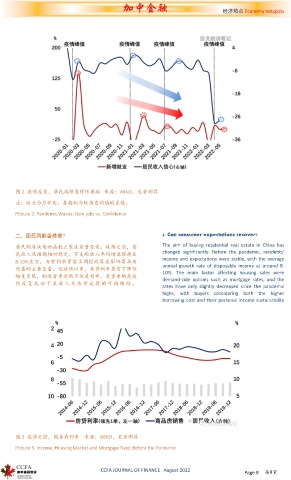

图 2. 疫情反复,居民端修复弹性递减 来源:WIND,笔者测算

注:就业为月环比;各指标为较历史均值的差值。

Picture 2. Pandemic Waves: New jobs vs. Confidence

二、居民端能否修复? 2. Can consumer expectations recover?

The aim of buying residential real estate in China has

居民购房决策的函数正发生显著变化。疫情之前,居

民收入及预期相对稳定,可支配收入年均增速保持在 changed significantly. Before the pandemic, residents’

8-10%左右,房贷利率等需求调控政策是影响商品房 income and expectations were stable, with the average

annual growth rate of disposable income at around 8-

销售的主要变量。但疫情以来,房贷利率虽有下降但 10%. The main factor affecting housing sales were

幅度有限,购房者考虑的不仅是利率,更重要的是疫 demand-side policies such as mortgage rates, and the

情 反 复 扰 动 下 其 收 入 及 房 贷 还 款 的 可 持 续 性 。

rates have only slightly decreased since the pandemic

highs, with buyers considering both the higher

borrowing cost and their personal income sustainability

.

图 3. 疫情之前,购房看利率 来源:WIND,笔者测算

Picture 3. Income, Housing Market and Mortgage Rate: Before the Pandemic

CCFA JOURNAL OF FINANCE August 2022 Page 9 第9页