Page 22 - CCFAJournal-FirstIssue

P. 22

加中金融

然而,如今情况正发生变化。由于担忧美股上涨不可持续,许 However, things are changing now. Fearing that the rise of US stocks is

多机构和部分散户开始大面积抛售,从股市下车。美国新老 unsustainable, many institutions and some individual investors began to

“韭菜”的资金动向显现出明显代际分歧。“父辈投资者们持 sell off widely and get off the stock market. The fund movements of

续抛售共同基金和 ETF,而年轻一代的投资者,仍像 1999 年时 different individual investors in the United States show clear inter-

generational differences. “Elder generation investors continue to sell

那样哄抢接盘。” 对于婴儿潮一代的大部分父辈投资者,经历 mutual funds and ETFs, while the younger generation of investors are still

了科技股泡沫时期美股惨跌之后,如今一个明显的趋势是,他 robbing the market as they did in 1999.” For most of the elder generation

们将原本投向风险资产的资金,逐渐调配到风险较低的货币市 investors of the “baby boom” generation, after the collapse of US stocks

场。具体来说,他们大举抛售股票基金 ETF,而投资组合中现 during the tech stock bubble, an obvious trend today is that they will

金持有量大幅增加,联储兜底的“无风险”债券市场受到广泛 gradually allocate funds originally invested in risky assets to gradually

青睐。 lower risk money markets. Specifically, they sold stock fund ETFs

aggressively, and the amount of cash held in their portfolios increased

零佣金交易平台 Robinhood 的数据显示疫情期间受到千禧一代 substantially. The Fed’s “risk-free” bond market was widely favored.

年轻散户投资者的青睐。许多用户对于高风险股票给予强烈关 Data from the zero-commission trading platform Robinhood shows that it

注和看好。例如,赫兹租车破产后发行新股,隔夜股价暴涨逾 was favored by young individual investors during the outbreak. Many

30%。一些受疫情影响较大的公司,如航空公司、赌场和酒店, users give strong attention and optimism to high-risk stocks. For example,

以及一些投机性非常强的股票,纷纷收获大量资金流入,年轻 when Hertz car rental went bankrupt, new shares were issued, and the

投资者们普遍认为,这类股在疫情好转后将会有非常好的股价 stock price soared more than 30% overnight. Some companies that are

表现。 more affected by the epidemic, such as airlines, casinos and hotels, as well

as some highly speculative stocks, have harvested a lot of capital inflows.

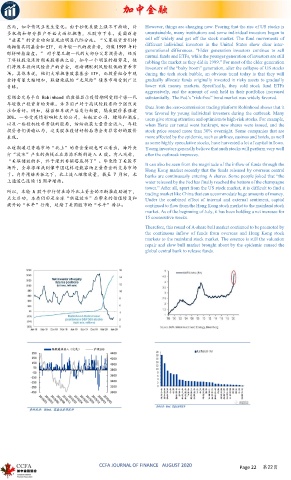

从近期通过香港市场“北上”的资金量级也可以看出,海外央 Young investors generally believe that such stocks will perform very well

行“放水”产生的热钱正在源源不断的进入 A 股。有人戏称, after the outbreak improves.

“美联储放的水,终于漫到香槟塔底部了”。毕竟除了美股市 It can also be seen from the magnitude of the inflow of funds through the

场外,全球很难找到像中国这样还能容纳巨量资金的交易市场 Hong Kong market recently that the funds released by overseas central

了。内外情绪共振之下,北上流入继续放量,截至 7 月初,北 banks are continuously entering A shares. Some people joked that “the

上通道已连续 15 周净增持。 water released by the Fed has finally reached the bottom of the champagne

tower.” After all, apart from the US stock market, it is difficult to find a

所以,本轮 A 股牛市行情在海外北上资金的不断推波助澜下, trading market like China that can accommodate huge amounts of money.

点火启动,本质仍旧是全球“新冠放水”后带来的估值修复和 Under the combined effect of internal and external sentiment, capital

提升的“水牛”行情,延续了美国股市的“水牛”特征。 continued to flow from the Hong Kong stock market to the mainland stock

market. As of the beginning of July, it has been holding a net increase for

15 consecutive weeks.

Therefore, this round of A-share bull market continued to be promoted by

the continuous inflow of funds from overseas and Hong Kong stock

markets to the mainland stock market. The essence is still the valuation

repair and slow bull market brought about by the epidemic caused the

global central bank to release funds.

CCFA JOURNAL OF FINANCE AUGUST 2020 Page 22 第22页