Page 23 - CCFAJournal-FirstIssue

P. 23

加中金融

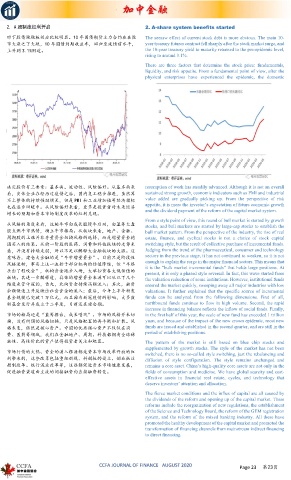

2. A 股制度红利开启 2. A-share system benefits started

时下股债跷跷板效应比较明显。10 年国债期货主力合约在在股 The seesaw effect of current stock debt is more obvious. The main 10-

市大涨之下大跌,10 年国债到期收益率,回归至疫情前水平, year treasury futures contract fell sharply after the stock market surge, and

上升到 3.1%附近。 the 10-year treasury yield to maturity returned to the pre-epidemic level,

rising to around 3.1%.

There are three factors that determine the stock price: fundamentals,

liquidity, and risk appetite. From a fundamental point of view, after the

physical enterprises have experienced the epidemic, the domestic

决定股价有三要素:基本面、流动性、风险偏好。从基本面来 resumption of work has steadily advanced. Although it is not an overall

看,实体企业在经历过疫情之后,国内复工稳步推进,虽然算 sustained strong growth, economic indicators such as PMI and industrial

不上整体的持续强劲增长,但是 PMI 和工业增加值等经济指标 value added are gradually picking up. From the perspective of risk

appetite, it is more the investor’s expectation of future economic growth

也在逐步回暖中。从风险偏好来看,更多是投资者对未来经济

and the dividend payment of the reform of the capital market system.

增长的预期和资本市场制度改革的红利兑现。

From a style point of view, this round of bull market is started by growth

从风格的角度来看,这轮牛市由成长股慢牛启动,由蓝筹大盘 stocks, and bull markets are started by large-cap stocks to establish the

股点燃牛市热情,确立牛市格局。从板块来看,地产、金融、 bull market pattern. From the perspective of the industry, the rise of real

周期股的上涨并非存量资金切换风格的选择,而是增量资金抱 estate, finance, and cyclical stocks is not a choice of stock capital

团买入的结果。从前一阶段的医药、消费和科技板块的走势来 switching style, but the result of collective purchase of incremental funds.

看,并没有持续走弱,所以不足以解释大金融板块的大涨。这 Judging from the trend of the pharmaceutical, consumer and technology

sectors in the previous stage, it has not continued to weaken, so it is not

意味着,建仓大金融的是“牛市增量资金”。目前只是阶段性

enough to explain the surge in the major financial sectors. This means that

风格逆转,事实上这一波始于部分机构的估值降维,但“半路

it is the “bulk market incremental funds” that holds large positions. At

杀出了程咬金”,机构资金跑步入场,大举扫货各大低估值的

present, it is only a phased style reversal. In fact, this wave started from

板块。其进一步解释道,具体的增量资金来源可以从以下几个 the valuation reduction of some institutions. However, institutional funds

维度来管中窥豹,首先,北向资金持续高额流入;其次,融资 entered the market quickly, sweeping away all major industries with low

余额快速上升反映出社会资金的流入;最后,今年上半年新发 valuations. It further explained that the specific source of incremental

基金规模已突破 1 万亿元,而且因为新冠疫情的影响,大多数 funds can be analyzed from the following dimensions. First of all,

新基金发行并成立于二季度,目前还在建仓期。 northbound funds continue to flow in high volume. Second, the rapid

increase in financing balance reflects the inflow of social funds. Finally,

市场的格局还是“蓝筹搭台,成长唱戏”。市场的风格并未切 in the first half of this year, the scale of new fund has exceeded 1 trillion

换,没有所谓的风格切换,只是风格配置的再平衡和扩散。风 yuan, and because of the impact of the new crown epidemic, most new

格未变,依然是核心资产。中国的优质核心资产不仅仅在消 funds are issued and established in the second quarter, and are still in the

period of establishing positions.

费、医药等领域,我们在金融地产、周期、科技都拥有全球稀

缺性、高性价比的资产值得投资者关注和配置。 The pattern of the market is still based on blue chip stocks and

supplemented by growth stocks. The style of the market has not been

市场行情的火热、资金的涌入根源都是资本市场改革开放的红

switched, there is no so-called style switching, just the rebalancing and

利带来的,这些改革包括重组新规、科创板的设立、创业板注 diffusion of style configuration. The style remains unchanged and

册制改革、银行混业改革等,这些都促进资本市场健康发展, remains a core asset. China’s high-quality core assets are not only in the

促进融资渠道由主流的间接融资向直接融资转变。 fields of consumption and medicine. We have global scarcity and cost-

effective assets in financial real estate, cycles, and technology that

deserve investors’ attention and allocation.

The fierce market conditions and the influx of capital are all caused by

the dividends of the reform and opening up of the capital market. These

reforms include the reorganization of new regulations, the establishment

of the Science and Technology Board, the reform of the GEM registration

system, and the reform of the mixed banking industry. All these have

promoted the healthy development of the capital market and promoted the

transformation of financing channels from mainstream indirect financing

to direct financing.

CCFA JOURNAL OF FINANCE AUGUST 2020 Page 23 第23页