Page 10 - MRT 1-2

P. 10

ii. Reduction to a lower time scale of pay, grade, post or service with or without further

directions regarding conditions of restoration to the grade or post or service from which

the Railway Servant was reduced and his seniority and pay on such restoration to that

grade, post or service

iii. Compulsory retirement

iv. Removal from service which shall not be a disqualification for future employment under

the Govt. or Railway Administration

Dismissal from service which shall ordinarily be a disqualification for future employment

under the Govt. or Railway Administration

Q 8. Study Leave

Study leave may be sanctioned for higher studies or technical subject having a direct and

close connection with his spare duty in or outside of India.

- Maximum leave sanctioned 1095 days or 3 years

- This leave is admissible after completion of five years

Q 9. Casual Leave

It is granted for sudden requirements or needs for all groups (A, B, C & D) and it is not a

recorded leave.

- CL may be prefixed or suffixed to holidays.

- 8 days of CL’s are admissible for all servants who are eligible to avail of all public

holidays or workshop paid holidays in a year.

- 10 days of CL’s to the servants who because of nature of their duties are not allowed

to avail public holidays.

- CL can be granted for half day also.

- There is no limit on CL’s to be availed at a time.

- CL cannot be combined with any other leave except compensatory CL.

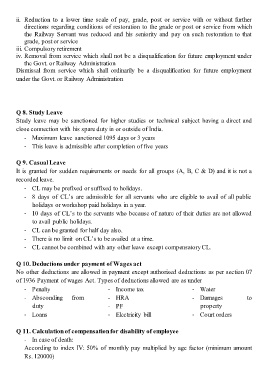

Q 10. Deductions under payment of Wages act

No other deductions are allowed in payment except authorised deductions as per section 07

of 1936 Payment of wages Act. Types of deductions allowed are as under

- Penalty - Income tax - Water

- Absconding from - HRA - Damages to

duty - PF property

- Loans - Electricity bill - Court orders

Q 11. Calculation of compensation for disability of employee

- In case of death:

According to index IV: 50% of monthly pay multiplied by age factor (minimum amount

Rs. 120000)