Page 38 - Banking Finance April 2020

P. 38

ARTICLE

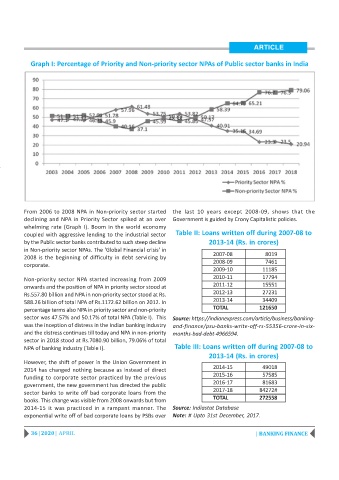

Graph I: Percentage of Priority and Non-priority sector NPAs of Public sector banks in India

From 2006 to 2008 NPA in Non-priority sector started the last 10 years except 2008-09, shows that the

declining and NPA in Priority Sector spiked at an over Government is guided by Crony Capitalistic policies.

whelming rate (Graph I). Boom in the world economy

coupled with aggressive lending to the industrial sector Table II: Loans written off during 2007-08 to

by the Public sector banks contributed to such steep decline 2013-14 (Rs. in crores)

in Non-priority sector NPAs. The 'Global Financial crisis' in

2007-08 8019

2008 is the beginning of difficulty in debt servicing by

2008-09 7461

corporate.

2009-10 11185

Non-priority sector NPA started increasing from 2009 2010-11 17794

onwards and the position of NPA in priority sector stood at 2011-12 15551

Rs.557.80 billion and NPA in non-priority sector stood at Rs. 2012-13 27231

588.26 billion of total NPA of Rs.1172.62 billion on 2012. In 2013-14 34409

percentage terms also NPA in priority sector and non-priority TOTAL 121650

sector was 47.57% and 50.17% of total NPA (Table I). This Source: https://indianexpress.com/article/business/banking-

was the inception of distress in the Indian banking industry and-finance/psu-banks-write-off-rs-55356-crore-in-six-

and the distress continues till today and NPA in non-priority months-bad-debt-4966594.

sector in 2018 stood at Rs.7080.90 billion, 79.06% of total

NPA of banking industry (Table I). Table III: Loans written off during 2007-08 to

2013-14 (Rs. in crores)

However, the shift of power in the Union Government in

2014 has changed nothing because as instead of direct 2014-15 49018

2015-16 57585

funding to corporate sector practiced by the previous

2016-17 81683

government, the new government has directed the public

2017-18 84272#

sector banks to write off bad corporate loans from the

TOTAL 272558

books. This change was visible from 2008 onwards but from

2014-15 it was practiced in a rampant manner. The Source: Indiastat Database

exponential write off of bad corporate loans by PSBs over Note: # Upto 31st December, 2017.

36 | 2020 | APRIL | BANKING FINANCE