Page 95 - Records of Bahrain (5) (ii)_Neat

P. 95

Rcucnue—expenditure budgets 417

inclination, in to forestall ariticiom or agita

tion. It may toko some timo to work out program

med, but to bogin with it would ba as wall to corw

toraplato an annual expenditure for aoveral yeara

of Rs. 2£ lakhs on new schemas# Actually tha

figure may vary greatly from year to year, but I

suggest this as a working figure*

C* It follows then that while the Reserve

is boing created over a period of - say - 15 years,

the State will probably be charging an average of

* *

Alternatively Rs. 4 lakhs plus Rs. 2$ lakhs against (i) oil ro

Rs. 3»V lakhs

end Rs. 3 lakhs. yalties and (ii) interest on invested royalties

(the latter boing on annually increasing sum)*

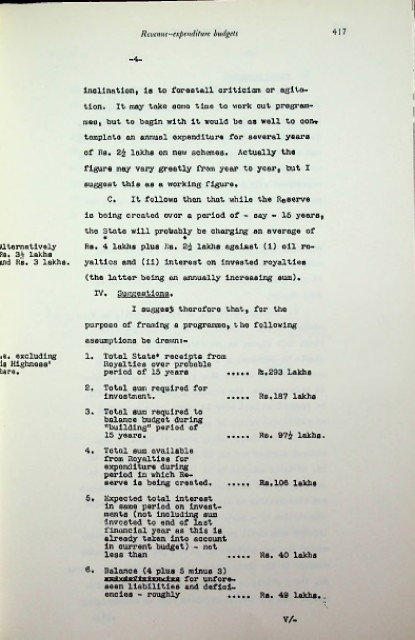

IV. Suggestions.

I suggest therefore that, for the

purpooo of framing a programme, the following

assumptions be drawni-

•a. excluding 1* Total State* receipts from

is Highness* Royalties over probable

hare. period of 15 years • Rs.293 Lakhs

2, Total sum required for

investment, • • Rs.187 lakhs

3. Total sura required to

balance budget during

"building11 period of

15 years. •• Re* 97£ lakhs.

4* Total sura available

from Royalties for

expenditure during

period in which Re

serve is being created* •• Rs.106 lakhs

5* Expected total interest

in same period on invest

ments (not including sum

invested to end of last

financial year as this is

already taken into account

in current budget) - not

less than •. Rs. 40 lakhs

6* Balance (4 plus 5 minus 3)

mtdxdaftg:fom>dbta for unfore

seen liabilities and defici

encies - roughly ## Rs* 49 lakhs*.

V/-