Page 15 - CCFA Journal - Seventh Issue

P. 15

加中金融 新兴市场 EM Markets

Regional headwinds

Escalating geopolitics are creating challenges from every direction. The reality of war has hit Europe, with the Russian invasion

of Ukraine perhaps the biggest shift in the region’s geopolitical landscape since the fall of the Berlin Wall in 1989. At the time

of writing, it is driving huge volatility across global markets.

Elsewhere in the CEEMEA region, Turkey’s unorthodox policy approach is bringing the country to the brink of a crisis, while a

number of countries, including South Africa, face growth challenges.

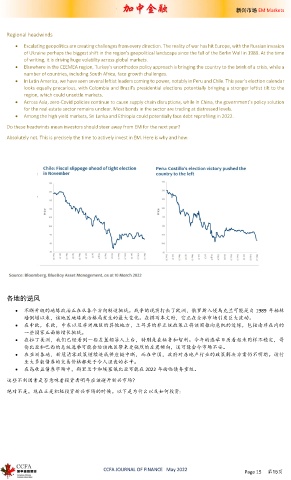

In Latin America, we have seen several leftist leaders coming to power, notably in Peru and Chile. This year’s election calendar

looks equally precarious, with Colombia and Brazil’s presidential elections potentially bringing a stronger leftist tilt to the

region, which could unsettle markets.

Across Asia, zero-Covid policies continue to cause supply chain disruptions, while in China, the government’s policy solution

for the real estate sector remains unclear. Most bonds in the sector are trading at distressed levels.

Among the high yield markets, Sri Lanka and Ethiopia could potentially face debt reprofiling in 2022.

Do these headwinds mean investors should steer away from EM for the next year?

Absolutely not. This is precisely the time to actively invest in EM. Here is why and how:

各地的逆风

不断升级的地缘政治正在从各个方向制造挑战。战争的现实打击了欧洲,俄罗斯入侵乌克兰可能是自 1989 年柏林

墙倒塌以来,该地区地缘政治格局发生的最大变化。在撰写本文时,它正在全球市场引发巨大波动。

在中欧,东欧,中东以及非洲地区的其他地方,土耳其的非正统政策正将该国推向危机的边缘,包括南非在内的

一些国家正面临增长挑战。

在拉丁美洲,我们已经看到一些左翼领导人上台,特别是在秘鲁和智利。今年的选举日历看起来同样不稳定,哥

伦比亚和巴西的总统选举可能会给该地区带来更强烈的左翼倾向,这可能会令市场不安。

在亚洲各地,新冠清零政策继续造成供应链中断,而在中国,政府对房地产行业的政策解决方案仍不明朗。该行

业大多数债券的交易价格都处于令人沮丧的水平。

在高收益债券市场中,斯里兰卡和埃塞俄比亚可能在 2022 年面临债务重组。

这些不利因素是否意味着投资者明年应该避开新兴市场?

绝对不是。现在正是积极投资新兴市场的时候。以下是为什么以及如何投资:

CCFA JOURNAL OF FINANCE May 2022

Page 15 第15页