Page 17 - CCFA Journal - Seventh Issue

P. 17

加中金融 新兴市场 EM Markets

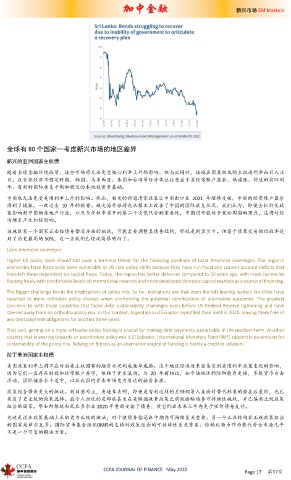

全球有 80 个国家—考虑新兴市场的地区差异

新兴的亚洲国家主权债

随着全球金融环境收紧,这些市场将无法免受核心利率上升的影响。但与此同时,该地区因其极低的主权违约率而引人注

目。在全球经济不稳定时期,韩国、马来西亚、泰国和台湾等经济体往往受益于其经常账户盈余、低通胀、舒适的实际利

率、有利的国际收支平衡和稳定的本地投资者基础。

中国也无法免受美国利率上升的影响。然而,相关的新冠清零政策让中国出口在 2021 年继续走强,中国的经常账户盈余

得到了提振。一改过去 10 年的颓势。缺乏海外旅游也从根本上改善了中国的国际收支状况。我们认为,即使去杠杆化政

策影响到中国的房地产行业,以及今年秋季召开的第二十次党代会的重要性,中国仍可能处于宽松周期的顶点,这将对经

济增长产生积极影响。

该地区有一个国家正面临债务偿还方面的挑战,可能需要调整其债务结构,那就是斯里兰卡。但鉴于债券交易的回收率达

到了历史最高的 50%,这一点我们已经说得很明白了。

Latin American sovereigns

Higher US policy rates should not pose a terminal threat for the financing positions of Latin American sovereigns. The region’s

economies have historically been vulnerable to US rate policy shifts because they have run fiscal and current account deficits that

have left them dependent on capital flows. Today, the region has better defences compared to 20 years ago, with most currencies

floating freely with comfortable levels of international reserves and more developed domestic capital markets as a source of financing.

The bigger challenge lies in the implications of policy mix. So far, indications are that even the left-leaning leaders like Chile have

reverted to more orthodox policy choices when confronting the potential ramifications of alternative outcomes. The greatest

concerns lie with those countries that faced debt sustainability challenges even before US Federal Reserve tightening and have

steered away from an orthodox policy mix. In this context, Argentina and Ecuador reprofiled their debt in 2020, leaving them free of

any debt payment obligations for another three years.

That said, getting on a more orthodox policy footing is crucial for making debt payments sustainable in the medium term. Another

country that is veering towards an unorthodox policy mix is El Salvador. International Monetary Fund (IMF) support is paramount for

sustainability of the policy mix. Relying on Bitcoin as an alternative source of funding is hardly a credible solution.

拉丁美洲国家主权债

美国政策利率上调不应对拉美主权国家的融资状况构成致命威胁。这个地区经济历来容易受到美国利率政策变化的影响,

因为它们一直存在财政和经常账户赤字,依赖于资本流动。与 20 年前相比,如今该地区的防御能力更强,多数货币自由

浮动,国际储备水平适中,以及比国内资本市场更为发达的融资来源。

政策组合带来更大的挑战。到目前为止,有迹象表明,即使是智利这样的左倾领导人在面对替代结果的潜在后果时,也已

恢复了更正统的政策选择。最令人担忧的是那些甚至在美联储收紧政策之前就面临债务可持续性挑战、并已偏离正统政策

组合的国家。譬如阿根廷和厄瓜多尔在 2020 年重新安排了债务,使它们在未来三年内免于任何债务支付。

也就是说在政策基础上采取更为正统的做法,对于使债务偿还在中期内可持续至关重要。另一个正在转向非正统政策组合

的国家是萨尔瓦多。国际货币基金组织(IMF)的支持对政策组合的可持续性至关重要。依赖比特币作为替代资金来源几乎

不是一个可靠的解决方案。

CCFA JOURNAL OF FINANCE May 2022

Page 17 第17页