Page 20 - CCFA Journal - Seventh Issue

P. 20

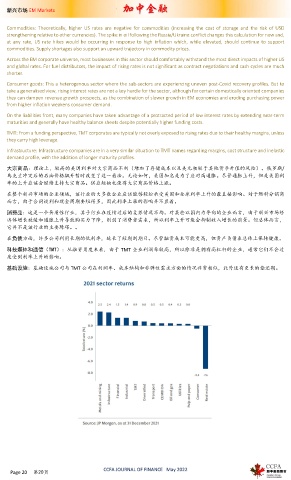

新兴市场 EM Markets 加中金融

Commodities: Theoretically, higher US rates are negative for commodities (increasing the cost of storage and the risk of USD

strengthening relative to other currencies). The spike in oil following the Russia/Ukraine conflict changes this calculation for now and,

at any rate, US rate hikes would be occurring in response to high inflation which, while elevated, should continue to support

commodities. Supply shortages also support an upward trajectory in commodity prices.

Across the EM corporate universe, most businesses in this sector should comfortably withstand the most direct impacts of higher US

and global rates. For fuel distributors, the impact of rising rates is not significant as contract negotiations and cash cycles are much

shorter.

Consumer goods: This a heterogenous sector where the sub-sectors are experiencing uneven post-Covid recovery profiles. But to

take a generalised view, rising interest rates are not a key hurdle for the sector, although for certain domestically oriented companies

they can dampen revenue growth prospects, as the combination of slower growth in EM economies and eroding purchasing power

from higher inflation weakens consumer demand.

On the liabilities front, many companies have taken advantage of a protracted period of low interest rates by extending near-term

maturities and generally have healthy balance sheets despite potentially higher funding costs.

TMT: From a funding perspective, TMT corporates are typically not overly exposed to rising rates due to their healthy margins, unless

they carry high leverage.

Infrastructure: Infrastructure companies are in a very similar situation to TMT names regarding margins, cost structure and inelastic

demand profile, with the addition of longer maturity profiles.

大宗商品:理论上,较高的美国利率对大宗商品不利(增加了存储成本以及美元相较于其他货币升值的风险)。俄罗斯/

乌克兰冲突后的石油价格飙升暂时改变了这一看法。无论如何,美国加息是为了应对高通胀。尽管通胀上升,但是美国利

率的上升应该会继续支持大宗商品。供应短缺也使得大宗商品价格上涨。

在整个新兴市场的企业领域,该行业的大多数企业应该能够轻松承受美国和全球利率上升的最直接影响。对于燃料分销商

而言,由于合同谈判和现金周期要短得多,因此利率上涨的影响并不显着。

消费品:这是一个异质性行业,其子行业在疫情过后的复苏情况不均。对某些以国内为导向的企业而言,由于新兴市场经

济体增长放缓和通胀上升导致购买力下降,削弱了消费者需求,所以利率上升可能会抑制收入增长的前景。但总体而言,

它并不是该行业的主要障碍。。

在负债方面,许多公司利用长期的低利率,延长了短期到期日。尽管融资成本可能更高,但资产负债表总体上保持健康。

科技媒体和通信(TMT):从融资角度来看,由于 TMT 企业利润率较高,所以除非是拥有高杠杆的企业,通常它们不会过

度受到利率上升的影响。

基础设施:基础设施公司与 TMT 公司在利润率、成本结构和非弹性需求方面的情况非常相似,此外还有更长的偿还期。

CCFA JOURNAL OF FINANCE May 2022

Page 20 第20页