Page 19 - CCFA Journal - Seventh Issue

P. 19

加中金融 新兴市场 EM Markets

Why invest in EM hard currency sovereign debt?

First, in our view, over 90% of the issuers are able to cope with higher US rates and deliver higher carry than developed market (DM)

credits without debt sustainability issues.

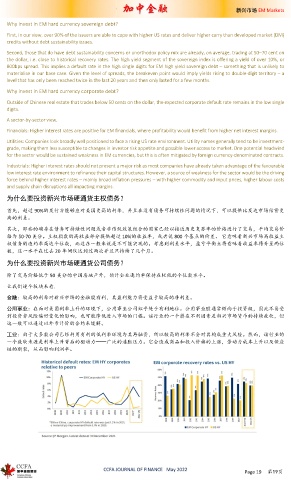

Second, those that do have debt sustainability concerns or unorthodox policy mix are already, on average, trading at 50–70 cent on

the dollar, i.e. close to historical recovery rates. The high yield segment of the sovereign index is offering a yield of over 10%, or

800bps spread. This implies a default rate in the high single digits for EM high yield sovereign debt – something that is unlikely to

materialise in our base case. Given the level of spreads, the breakeven point would imply yields rising to double-digit territory – a

level that has only been reached twice in the last 20 years and then only lasted for a few months.

Why invest in EM hard currency corporate debt?

Outside of Chinese real estate that trades below 50 cents on the dollar, the expected corporate default rate remains in the low single

digits.

A sector-by-sector view.

Financials: Higher interest rates are positive for EM financials, where profitability would benefit from higher net interest margins.

Utilities: Companies look broadly well positioned to face a rising US rate environment. Utility names generally tend to be investment-

grade, making them less susceptible to changes in investor risk appetite and possible lower access to market. One potential headwind

for the sector would be sustained weakness in EM currencies, but this is often mitigated by foreign currency-denominated contracts.

Industrials: Higher interest rates should not present a major risk as most companies have already taken advantage of the favourable

low interest rate environment to refinance their capital structures. However, a source of weakness for the sector would be the driving

force behind higher interest rates – mainly broad inflation pressures – with higher commodity and input prices, higher labour costs

and supply chain disruptions all impacting margins.

为什么要投资新兴市场硬通货主权债务?

首先,超过 90%的发行方能够应对美国更高的利率,并且在没有债务可持续性问题的情况下,可以提供比发达市场信贷更

高的利差。

其次,那些的确存在债务可持续性问题或者非传统政策组合的国家已经以接近历史复苏率的价格进行了交易,平均交易价

格为 50-70 美分。主权指数的高收益部分提供超过 10%的收益率,或者说 800 个基点的价差。 它意味着新兴市场高收益主

权债务的违约率高达个位数,而这在一般来说是不可能实现的。考虑到利差水平,盈亏平衡点将意味着收益率将升至两位

数,这一水平在过去 20 年间仅达到过两次并且只持续了几个月。

为什么要投资新兴市场硬通货公司债务?

除了交易价格低于 50 美分的中国房地产外,预计企业违约率保持在较低的个位数水平。

让我们逐个板块来看.

金融:较高的利率对新兴市场的金融股有利,其盈利能力将受益于较高的净利差。

公用事业:在面对美国利率上升的环境下,公用事业公司似乎处于有利地位。公用事业股通常倾向于投资级,因此不易受

到投资者风险偏好变化的影响,也可能降低进入市场的门槛。该行业的一个潜在不利因素是新兴市场货币的持续疲软,但

这一般可以通过以外币计价的合约来缓解。

工业:由于大多数公司已经利用有利的低利率环境为其再融资,所以较高的利率不会对其构成重大风险。然而,该行业的

一个疲软来源是利率上升背后的驱动力——广泛的通胀压力。它会造成商品和投入价格的上涨,劳动力成本上升以及供应

链的断裂,从而影响利润率。

CCFA JOURNAL OF FINANCE May 2022

Page 19 第19页