Page 21 - CCFA Journal - Seventh Issue

P. 21

加中金融 新兴市场 EM Markets

Why invest in EM local currency debt?

Local currency is the most unloved of the EM sub-asset classes. It has delivered negative sovereign returns at the beta level for the

last 12 years, leaving investors understandably lacking in enthusiasm. Somewhat ironically, it is the leading asset class year-to-date

across global fixed income markets and it is the only asset class that is in positive territory, up 2%. US rates are down close to 4%, US

investment grade debt is down some 4.6% and CEMBI HC indices are down 2-3.5% (as at Feb 2022).

Conventional wisdom would say that EM local debt should underperform in a rising rates environment, so what’s driving the positive

performance and can it be maintained?

There are three indications suggesting that a large part of the damage has already been done and that the flow dynamic, combined

with positive fundamentals, could support continued performance for the asset class.

1. In response to inflation fears, EM central banks took a pre-emptive hiking stance last year. EM local rates at the front end of the

curve (2-year rates) repriced between 300-400bps as a result –some are now half way through their hiking cycle now, some are fully

materialised. This pre-emptive approach has created an FX buffer. In key EM beta currencies, the cost of shorting has become

prohibitively expensive – the highest it has been in 10 years. It ranges from 5-6% in the likes of Mexico, South Africa and Chile to a

whopping 11% for Brazil. It would cost you 11% to short the Brazilian real, meaning if you wanted to express a negative view on the

currency, you’d have to take a hard bet of an extreme event, such as a domestic crisis, to justify the cost of a short position.

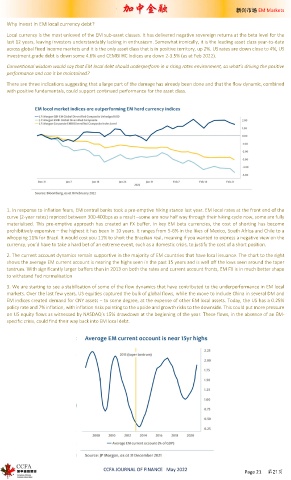

2. The current account dynamics remain supportive in the majority of EM countries that have local issuance. The chart to the right

shows the average EM current account is nearing the highs seen in the past 15 years and is well off the lows seen around the taper

tantrum. With significantly larger buffers than in 2013 on both the rates and current account fronts, EM FX is in much better shape

to withstand Fed normalisation

3. We are starting to see a stabilisation of some of the flow dynamics that have contributed to the underperformance in EM local

markets. Over the last few years, US equities captured the bulk of global flows, while the move to include China in several DM and

EM indices created demand for CNY assets – to some degree, at the expense of other EM local assets. Today, the US has a 0.25%

policy rate and 7% inflation, with inflation risks pointing to the upside and growth risks to the downside. This could put more pressure

on US equity flows as witnessed by NASDAQ’s 15% drawdown at the beginning of the year. These flows, in the absence of an EM-

specific crisis, could find their way back into EM local debt.

CCFA JOURNAL OF FINANCE May 2022

Page 21 第21页