Page 16 - CCFA Journal - Seventh Issue

P. 16

新兴市场 EM Markets 加中金融

Why Invest?

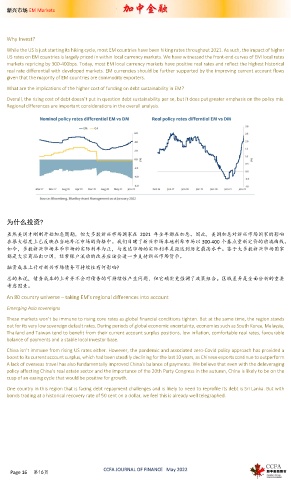

While the US is just starting its hiking cycle, most EM countries have been hiking rates throughout 2021. As such, the impact of higher

US rates on EM countries is largely priced in within local currency markets. We have witnessed the front-end curves of EM local rates

markets repricing by 300-400bps. Today, most EM local currency markets have positive real rates and reflect the highest historical

real rate differential with developed markets. EM currencies should be further supported by the improving current account flows

given that the majority of EM countries are commodity exporters.

What are the implications of the higher cost of funding on debt sustainability in EM?

Overall, the rising cost of debt doesn’t put in question debt sustainability per se, but it does put greater emphasis on the policy mix.

Regional differences are important considerations in the overall analysis.

为什么投资?

虽然美国才刚刚开始加息周期,但大多数新兴市场国家在 2021 年全年都在加息。因此,美国加息对新兴市场国家的影响

在很大程度上已反映在当地外汇市场的价格中。我们目睹了新兴市场本地利率市场以 300-400 个基点重新定价的前端曲线。

如今,多数新兴市场本币市场的实际利率为正,与发达市场的实际利率差距达到历史最高水平。鉴于大多数新兴市场国家

都是大宗商品出口国,经常账户流动的改善应该会进一步支持新兴市场货币。

融资成本上升对新兴市场债务可持续性有何影响?

总的来说,债务成本的上升并不会对债务的可持续性产生问题,但它确实更强调了政策组合。区域差异是全面分析的重要

考虑因素。

An 80 country universe – taking EM’s regional differences into account

Emerging Asia sovereigns

These markets won’t be immune to rising core rates as global financial conditions tighten. But at the same time, the region stands

out for its very low sovereign default rates. During periods of global economic uncertainty, economies such as South Korea, Malaysia,

Thailand and Taiwan tend to benefit from their current account surplus positions, low inflation, comfortable real rates, favourable

balance of payments and a stable local investor base.

China isn’t immune from rising US rates either. However, the pandemic and associated zero-Covid policy approach has provided a

boost to its current account surplus, which had been steadily declining for the last 10 years, as Chinese exports continue to outperform.

A lack of overseas travel has also fundamentally improved China’s balance of payments. We believe that even with the deleveraging

policy affecting China’s real estate sector and the importance of the 20th Party Congress in the autumn, China is likely to be on the

cusp of an easing cycle that would be positive for growth.

One country in this region that is facing debt repayment challenges and is likely to need to reprofile its debt is Sri Lanka. But with

bonds trading at a historical recovery rate of 50 cent on a dollar, we feel this is already well telegraphed.

CCFA JOURNAL OF FINANCE May 2022

Page 16 第16页